When applying for a working holiday visa, most countries require you to have adequate travel insurance covering your entire stay. In fact, your visa application may be rejected if you don’t have a suitable insurance policy.

Even if it’s not mandatory for your working holiday visa, getting the right travel insurance is still extremely important! That’s because it will protect you if something goes wrong during your trip. It doesn’t just cover medical costs, but many other unexpected events that can happen when you’re travelling as well.

There are lots of companies that sell travel insurance to Australians. But it can be difficult to find one that meets both your own needs and the visa requirements for a working holiday.

If you’re heading to Europe, your travel insurance may also need to include minimum coverage for certain things like repatriation costs.

This comprehensive guide explains everything you need to know about travel insurance for Australian backpackers.

🎯 Just want the TL;DR version?

You’ll find a list of travel insurance options suitable for Australians on a working holiday towards the end of this article.

But if you have the time, we’d recommend reading this guide in full as there are lots of important things to consider before buying travel insurance!

- Things backpackers should consider when choosing travel insurance

- Single-trip policies don’t let you visit home during your working holiday year

- Most policies have a maximum validity of 12 months

- Annual multi-trip policies aren’t suitable for long-term trips or living overseas

- Some insurance won’t cover you while working overseas

- Don’t want to risk paying for insurance before your visa is approved?

- Extra travel insurance requirements for Europe

- Recommended travel insurance for backpackers

- List of other travel insurance options

- Other resources to help you plan your working holiday

- Frequently Asked Questions (FAQs)

Things backpackers should consider when choosing travel insurance

Of course, your travel insurance policy doesn’t just need to meet the visa requirements. It also needs to work for you!

Make sure you read the Product Disclosure Statement (PDS) carefully to ensure your policy covers all of the places you’ll be visiting and the types of activities you’ll be doing. For example, if you’ll be doing lots of skiing, make sure you choose a policy that covers snow sports. Some insurers only cover snow sports if you purchase this as an add-on.

If you have any pre-existing medical conditions, you should also check whether your insurer covers these.

Tip: PDS documents can be long and confusing to read! When looking for specific information in a travel insurance PDS, search for keywords such as “repatriation”, “COVID” “snow” or “sport” to easily find the section that you’re looking for.

Also beware that complimentary credit card travel insurance is not generally acceptable for working holiday visa applications.

Here are some other common problems that backpackers may encounter when purchasing a long-term travel insurance policy…

Single-trip policies don’t let you visit home during your working holiday year

Most single-trip travel insurance policies cover a single return journey from Australia.

The coverage usually ends the moment you return home to Australia, even if there are still many months left to run on your policy. This could cause problems if you plan to return to Australia for a short, temporary visit during your gap year.

There is generally an exception if the reason you need to return home mid-trip is the sudden illness or death of a relative. In this case, many policies will allow you to resume your trip and continue to cover you while outside Australia. The insurance may even pay for your trip back to Australia. But this doesn’t include planned holidays or family visits.

Workaround:

If this affects you, consider purchasing a backpacker insurance policy that specifically allows you to return to Australia for one or more short visits.

If you’re travelling to Canada, IEC Insurance is a good option as you may temporarily return to Australia without voiding the rest of your policy. Fast Cover also lets you return to Australia mid-trip without automatically ending your insurance coverage.

Most policies have a maximum validity of 12 months

Most travel insurers only offer coverage for a maximum single-trip length of 12 months. A small number of insurers, such as Travel Insurance Direct, won’t even let you choose a policy end date more than a year after the date of purchase. This could be a problem if you plan to be away for more than a year.

Workaround:

Freely lets you buy travel insurance for trips lasting up to 18 months, and Southern Cross Travel Insurance lets you buy a two-year policy over the phone if you have a working holiday visa for Canada, USA or UK.

IEC Insurance also offers 18 and 24-month policies for working holidays in Canada, with the added advantage that you can easily purchase your policy online.

Several other insurers will also let you extend your initial policy for up to an additional year for an extra fee.

If you plan to travel a bit more after your working holiday ends, but before returning to Australia, you may also consider purchasing a separate one-way travel insurance policy that commences outside of Australia. This would cover the period from when your working holiday finishes until your arrival back into Australia.

Annual multi-trip policies aren’t suitable for long-term trips or living overseas

As an alternative to a single-trip policy, most travel insurers offer annual multi-trip insurance. This covers multiple return trips from Australia, but only up to a certain trip length. They’ll also only cover you for a maximum total amount of time spent outside Australia during a given year.

Beware: For this reason, annual multi-trip policies are generally unsuitable for working holidays.

Some insurance won’t cover you while working overseas

Most travel insurance offers some level of coverage in case something happens while you are working overseas, such as during a working holiday. But there are exceptions as standard single and multi-trip travel insurance policies are generally designed for people going overseas for a holiday or short business trip.

Insurers that do cover overseas work may have exclusions for certain types of jobs that involve manual labour or are considered high-risk. These include occupations such as firefighting or working with animals. If this applies to you, check the PDS before purchasing your insurance.

Workaround:

Some travel insurers offer specialist backpacker or “working overseas” policies that cover overseas work, including Southern Cross Travel Insurance.

If your Australian travel insurance doesn’t cover this, you may also consider getting local health insurance in the country where you are working. (In some countries such as Germany or the Netherlands, this may even be legally required.)

Don’t want to risk paying for insurance before your visa is approved?

Keep in mind that some insurance policies have a “cooling-off” period of between 2-4 weeks. This lets you cancel your policy for a full refund if you change your mind within the cooling-off period. This is only possible if you haven’t yet started your trip.

Extra travel insurance requirements for Europe

If you’re applying for a working holiday visa in a Schengen country such as Germany, Greece or Italy, there may also be specific requirements about what your travel insurance must cover.

Most Schengen Area countries have similar minimum travel insurance requirements for Type-D Schengen visas. This includes working holiday visa and Work & Holiday visas.

When applying for a working holiday visa in Europe, your travel insurance would typically need to provide at least €30,000 worth of coverage for all of the following:

-

Emergency medical/hospitalisation expenses

-

Medical evacuation costs (i.e. the cost of flying you back to Australia for hospital treatment)

-

Repatriation costs (i.e. the cost of transporting your mortal remains back to Australia if you die)

At the current exchange rate, €30,000 is roughly equivalent to AUD52,000. This amount varies as the EUR/AUD exchange rate fluctuates.

Many travel insurance policies offer cover for the repatriation of mortal remains, but for less than the required amount. So, pay close attention to this!

Your insurance must be valid in all Schengen member states and be valid for the entire length of your trip. This means that if you apply for a 12-month visa but your travel insurance is only valid for 9 months, your working holiday visa may only be approved for 9 months.

Some countries, such as Germany, will also check that your health insurance covers pandemics such as COVID-19.

As part of your working holiday visa application, you may need to provide evidence that you hold travel insurance that meets this minimum criteria. That may include providing your certificate of insurance, and showing excerpts from the Product Disclosure Statement (PDS) which clearly state the level of coverage for the items listed above.

If your insurance doesn’t meet the minimum standards required by the country you’re travelling to, your visa application could be rejected. So, it’s really important to check the rules and your travel insurance policy carefully!

Insurance requirements may differ between countries

Visa conditions may differ between European countries. So, you should always confirm the requirements set by the specific country where you’re applying for your working holiday visa.

Countries that have reciprocal health care agreements with Australia, such as Belgium, Sweden and Norway, may have more lenient travel insurance requirements for Australian working holiday visa applicants. But this isn’t necessarily the case for all countries with a reciprocal Medicare agreement. You may still need to get travel insurance in order to get your visa.

Recommended travel insurance for backpackers

As you can see, selecting a suitable backpacker travel insurance policy can be a bit of a minefield!

To help you out, here are a few travel insurance options that may be suitable for Australians on different types of working holidays…

Freely

Freely offers affordable and flexible long-term travel insurance to Australians heading overseas for up to 18 months. That’s six months longer than the maximum period most other Australian insurers will cover! This makes Freely travel insurance ideal if you’re planning a full-year working holiday with a bit of extra travel between leaving and returning to Australia.

Although Freely normally provides up to $20,000 of cover if you die while overseas, there is an exception for people holding a valid Schengen Visa such as a working holiday visa in a Schengen member country. This makes it a suitable travel insurance option for working holidays in Europe.

This is the exact wording from the Freely PDS regarding cover for repatriation costs:

We will pay reasonable overseas funeral or cremation expenses or the cost of returning your remains to Australia if:

a) you die during the period of insurance. In either event the maximum amount we will pay in total will not exceed $20,000; or

b) you hold a valid Schengen Visa and you

die in a Schengen Member state during the period of insurance. In either event the maximum amount we will pay in total will not exceed 30,000EUR for expenses incurred in that Schengen Member state.

Freely also lets you extend your trip by changing your return date in the App. And you can pay for Daily Boosts to do things like skiing or motorcycling – you pay-per-day, as needed.

Plus, there’s a 21-day cooling-off period. You can get a full refund if you change your mind within 3 weeks of buying the policy and haven’t yet started your trip or made a claim.

Here are some key facts about Freely travel insurance:

- Underwriter: Zurich

- Cover for emergency medical expenses including evacuation: Unlimited

- Cover for repatriation of mortal remains: $20,000 or €30,000 with a valid Schengen visa

- Maximum policy length: 18 months

- Coverage ends as soon as you return to Australia? Yes

IEC Insurance (for Canada)

IEC Insurance, administered by Cover-More, is ideal for Australians and New Zealanders planning a working holiday in Canada. You can easily purchase a policy online with cover for 12, 18 or 24 months, and returning temporarily to Australia during your International Experience Canada stay won’t void the rest of your cover.

This policy is specifically designed for Aussies and Kiwis backpacking in Canada, with optional cover for snow sports. As it’s a worldwide policy, you’ll also be covered on any side trips you take outside of Canada (except while in Australia, if you visit home).

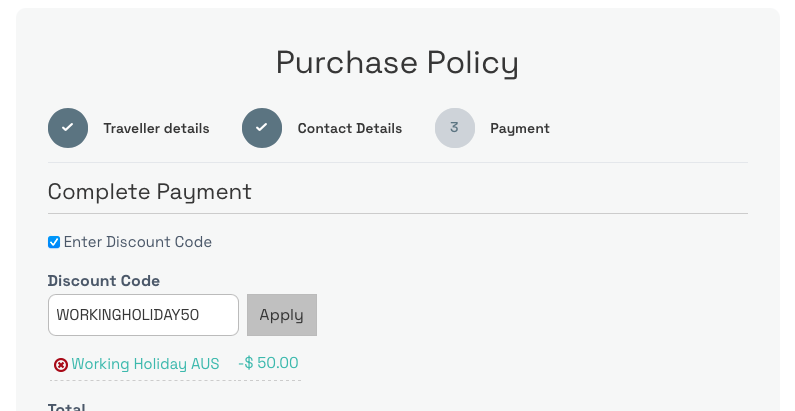

Plus, Working Holidays for Aussies readers can get $50 off any IEC Insurance policy! Simply enter the discount code WORKINGHOLIDAY50 at the checkout.

Here are some key facts about IEC Insurance:

- Underwriter: Zurich

- Cover for emergency medical expenses including evacuation: Unlimited

- Cover for repatriation of mortal remains: $20,000

- Maximum policy length: 24 months

- Coverage ends as soon as you return to Australia? No, your policy continues for the full duration that you have paid for (even if you return home), however no medical coverage is provided while in your home country during your visit home.

Fast Cover

Fast Cover is currently one of the few travel insurers in Australia that will let you return home to Australia for any reason while you’re still insured for your trip, and won’t automatically terminate the rest of your cover.

This is what the Fast Cover PDS says in the “Period of Insurance” section. The following excerpt applies to all Fast Cover travel insurance policies:

If you return home early for any reason, cover from your policy will be suspended from the time you return to your home until the time you leave your home to continue your trip. You must have 14 days remaining of the period of insurance as noted on your Certificate of Insurance. Following the resumption of your trip your policy will remain valid until the end date shown on your Certificate of Insurance or your permanent return home, whichever comes first. We will not pay any costs in relation to your return to Australia unless the costs are covered by this policy.

Fast Cover’s international travel insurance policies generally have a sub-limit of $20,000 for the cost of repatriating mortal remains. However, if you have a visa in a Schengen country, this limit increases to $60,000. This meets the requirements for European working holiday visas.

This is what the Fast Cover PDS says about repatriation costs:

If You have an approved and valid Schengen visa for Your Trip, the limit for repatriation of Your mortal remains from a Schengen listed country or state back to Australia is $60,000.

Although the maximum policy length you can purchase is for one year, Fast Cover provides the option to extend your insurance up to a travel period of 2 years.

Fast Cover also offers a 25-day money-back guarantee.

Here are some key facts about Fast Cover travel insurance:

- Underwriter: Lloyd’s

- Cover for emergency medical expenses including evacuation: Unlimited

- Cover for repatriation of mortal remains: $20,000 (or $60,000 if you have a European visa)

- Maximum policy length: 12 months (can extend for a total trip length of up to 24 months)

- Coverage ends as soon as you return to Australia? Not necessarily

Southern Cross Travel Insurance

Southern Cross Travel Insurance (SCTI) offers a dedicated “Working Overseas” travel insurance policy designed for Australian expats and backpackers on working holidays. As such, it also covers some types of work that you might do overseas and a range of medical services you might need while living overseas, including physiotherapy and dental care.

Going on a working holiday in Canada, the USA or the UK? Although Southern Cross only sells policies for trips up to 12 months online, you can buy a longer policy by calling them.

A trade-off is that the Southern Cross Working Overseas policy is often one of the more expensive working holiday travel insurance options.

Here are some key facts about Southern Cross travel insurance:

- Underwriter: Southern Cross (SCTI underwrites its own policies)

- Cover for emergency medical expenses including evacuation: Unlimited

- Cover for repatriation of mortal remains: $50,000

- Maximum policy length: 12 months (Australians getting a working holiday visa in Canada, USA or UK can get a 24-month policy over the phone)

- Coverage ends as soon as you return to Australia? Yes, unless your early return to Australia is due to an unexpected event (such as the unexpected death or serious illness of a relative under 85 years old)

AXA Schengen travel insurance

Most Australian travel insurance options require you to start and finish your journey in Australia. Some will still offer you a policy if you’re already overseas, but with extra limitations – and you still need to return to Australia at the end of your trip.

If you’re not starting or ending your trip in Australia, and you just want up to six months of cheap travel insurance that meets the requirements for visas in Schengen countries, AXA’s Schengen travel insurance could be suitable. AXA is not an Australian company, but you can purchase AXA Schengen insurance as an Australian resident.

Here are some key facts about AXA Schengen insurance:

- Underwriter: AXA Insurance

- Cover for emergency medical expenses including evacuation: €30,000 (with Schengen Low Cost policy) or €100,000 (with Schengen Europe Travel policy)

- Cover for repatriation of mortal remains: €30,000

- Maximum policy length: 6 months

- Coverage ends as soon as you return to Australia? No. In fact, it doesn’t matter whether you start, end or visit in Australia – this just covers your medical and other basic expenses while in Europe.

Just want a cheap option?

We compared the cost of travel insurance for a 25-year-old Australian travelling to Europe for one year with each of the providers listed in the table below. The cheapest insurance options appeared to be with Travel Insurance Saver, Australia Post and Tick Travel Insurance.

Tip: Save 10% on Australia Post Travel Insurance using the promo code TRAVEL10.

List of other travel insurance options

If you’d like more options, we’ve included some key information about the cover available to Aussies from a range of insurers in the table below:

| Insurer | Meets Schengen visa requirements? | Maximum cover length |

|---|---|---|

| Travel Insurance Direct | Yes | 12 months (from date of purchase) |

| World Nomads | No (only $25,000 for repatriation of remains) | 12 months |

| IEC Insurance (for Canada) | N/A | 24 months |

| Fast Cover | Yes | 12 months (and can extend for up to another year) |

| Freely | Yes | 18 months |

| Cover-More | Yes (Comprehensive+ Plan only) | 12 months |

| AXA | Yes | 6 months (but you don’t need to start or end your trip in Australia) |

| Go Insurance | Yes | 12 months (plus, can extend for up to another year) |

| Southern Cross Travel Insurance (Working Overseas policy) | No* ($50,000 for return of mortal remains – check exchange rate) | 12 months (you can get 24 months of cover over the phone for working holidays in Canada, USA & UK) |

| Medibank | Yes | 12 months |

| Insure4less | Yes | 12 months |

| Travel Insuranz | Yes | 12 months |

| Tick Travel Insurance | No* ($50,000 for return of mortal remains – check exchange rate) | 12 months |

| Australia Post | Yes | 12 months |

| Travel Insurance Saver | Yes | 12 months |

The list above is not exhaustive, but contains some of the most useful options for Australians who need travel insurance for a working holiday.

If you’re travelling to Europe, note that Tick and Southern Cross Travel Insurance provide AUD50,000 coverage for the repatriation of mortal remains. Based on the exchange rate at the time of writing, this would not meet the €30,000 requirement for a Schengen visa. This could change, depending on exchange rate movements.

Other resources to help you plan your working holiday

Planning a working holiday overseas? Working Holidays for Aussies has lots of other resources that can help you prepare for this exciting time in your life!

We have working holiday visa guides for all of the 40+ countries that offer these visas to Australian citizens:

These articles might also help you on your journey…

Frequently Asked Questions (FAQs)

Each country sets its own travel insurance requirements for backpackers. When applying for a working holiday visa in Europe, you’ll need to show proof of travel insurance that provides at least EUR30,000 of cover for emergency medical, evacuation and repatriation costs.

The complimentary travel insurance that comes with some credit cards does not usually meet the required standards for a working holiday visa and therefore may not be accepted.

Yes, travel insurance is extremely important as it will protect you if something goes wrong during your travels. It is also a mandatory requirement when applying for many working holiday visas.

Most Australian international travel insurance policies provide some level of cover for events relating to COVID-19, including if you or your travel companion contract COVID-19 and need medical treatment or need to alter your trip. However, things like border closures are not generally covered. Check the PDS for details about what your insurance policy may or may not cover.

A one-way travel insurance policy is designed only to cover you while you are in transit to an overseas destination. The cover will generally end within 24 hours of your arrival at your intended destination.

In general, you need to purchase travel insurance before you start your trip and you need to plan to return to Australia (or your home country) at the end of your trip. However, if you’ve already left the country, some insurers do offer travel insurance to cover the remainder of your trip until you get back to Australia. These policies typically do not provide any cover during the first few days after you purchase the policy and may have a higher excess.

When applying for a Schengen visa, your travel insurance must include at least EUR30,000 of coverage for emergency medical, evacuation and repatriation costs, including for the repatriation of mortal remains back to your home country.

Please note that the information on this page is general in nature only and does not consider your personal circumstances. Please consider your own personal circumstances and if in doubt, seek independent advice, before purchasing a financial product such as an insurance policy.

This page contains affiliate links. Working Holidays for Aussies may receive a commission if you make a purchase using a link provided on this page.

While best efforts are made to keep this information updated, we do not guarantee its accuracy. If you spot an error, would like to suggest new information to be added or simply have a question, please let us know in the comments.

Matt is the founder of Working Holidays for Aussies. Passionate about travel and always looking for great deals, he believes that a gap year is the perfect opportunity to immerse yourself in another culture and learn all the things they didn’t teach you in school!

Originally from Australia, Matt has travelled to over 100 countries, lived in 7 countries, and has extensive real-world experience with working holiday visas.

Hi Matt,

I’m confused as to the totals required for visas. After getting quotes for most of these options, the repatriation costs alone are usually $25,000. Is the $50,000 minimum a total? e.g. $25k for repatriation PLUS $25k for other medical costs = $50k. OR, is it each item needs to be covered for $50k, e.g. $50k for repatriation and $50k for other medical costs. I hope that makes sense!

Hi Lizzie,

For most European visas, the minimum requirement is at least €30,000 (or foreign currency equivalent, so around AUD50,000) of coverage for EACH of those things.

In other words, minimum $50,000 coverage for emergency medical expenses, AND $50,000 for evacuation costs, AND $50,000 for repatriation costs.

This is super important as many Schengen countries will deny your visa application if your insurance does not meet this criteria.

Hi Matt, thank you this article has been very helpful.

However I’m looking for an insurance policy that both meets schengan visa requirements for a whv in France, and allows for a short trip back to Australia for family engagements. Have you come across policies that offer these two criteria? I’m struggling to find any.

Cheers,

Benita

Hi Benita,

Sorry for the slow reply. I’ve been trying to find a policy that meets both criteria but I don’t think there currently is one. InsureandGo’s backpacker insurance may cover this as it appears they have increased the limit for repatriation costs to AUD50,000 however their backpacker policy type is not currently available. I believe it may be offered again from later this year.

Sorry that I couldn’t be more helpful – I wish there was an easy solution for you!

Hi,

I’m leaving shorty to go overseas to work in Scotland.

I have the Youth Mobility Scheme Visa and was under the impression that paying for the healthcare surcharge would cover me while I’m over there for any medical related expenses.

Therefore, I was not going to pay for health Insurance. I have read further into this and realised I would not be covered if I had to be repatriated back to Australia.

Unlikely, but you never know.

It was so expensive to pay the surcharge and I feel like I am kind of doubling up on paying for the medical side of things if I pay for health Insurance as well.

What are your thoughts?

I am guessing many Australians don’t pay for health Insurance cover as well.

Thanks!

Louise

Hi Louise. This is obviously a personal decision. Since you’ll be in the UK and paid the Immigration Health Surcharge, you would receive medical cover within the UK public health system while you’re there. But this doesn’t cover other expenses that travel insurance is designed to cover (such as lost luggage, trip cancellation costs and a whole lot of other things), nor as you say, repatriation costs.

In general, I would suggest that getting travel insurance for overseas trips is a very good idea – mainly so you’re not bankrupted in case you have a sudden medical emergency. But since you can already access basic medical/hospital services in the UK, it’s really up to you. This isn’t required for your visa.

Perhaps you might consider the cheapest available travel insurance policy that covers repatriation costs.

Another thing to consider is whether you’ll be doing much travel outside of the UK during your working holiday. Your travel insurance would also cover you during weekend trips to continental Europe and your flights to/from Australia, etc.

Hi, I’m just trying to get insurance that meets the requirements for a German Working Holiday Visa. I’m just struggling to find one that covers for pandemics, which is a requirement. I was just wondering if you had any advice on finding an appropriate insurance policy or knew any which provide cover for pandemics?

Thank you

You are correct that most travel insurance policies have a general exclusion for pandemics. However, many policies will cover certain costs relating to COVID-19, specifically.

Perhaps you could clarify with the German Consulate General whether you just need insurance that covers COVID-19, or whether it needs to be all pandemics – and if so, do they have a policy they suggest that meets this criteria?

If it just needs to cover medical, repatriation, hospitalisation and coronavirus travel costs relating to pandemics (but not necessarily other general expenses relating to pandemics), NIB and Travel Insurance Saver may work. (See https://api.nibtravelinsurance.com/products/v1/nibau/regulatoryWordingDocuments/INT-COM/HTML?Partnergroupid=9 and search for the word “pandemic” to see the relevant section in the PDS.)